Five hurdles ahead for Canada's power grid

Will Canada's electricity systems be able to keep pace with development plans

Welcome to the Powering Canada newsletter – covering developments in our electricity markets and how they impact the broader economy. I thought I’d kick this off with a look at five of the biggest stories I’ll be watching closely and sharing with you in 2026.

These developments will impact the type of power sources on our grid, whether Canada can meet our growing power needs, and the prices we pay in the years to come.

How we deal with AI datacenters

Canada is pushing to expand our economy quickly in response to US threats. Provinces must find a way to connect beneficial “major loads” to the grid without creating blackouts and rate hikes. “Major loads” are most popularly AI datacenters but include refineries, LNG plants, and mining operations.

On one hand, Canada wants to make the most of the AI boom and reduce our reliance on the US for natural resource processing, which would favour connection of any and all loads looking to set up shop here. On the other hand, not all loads are created equal in long-term economic benefits.

A key power market in the US has provided a warning against a “take all comers” approach. PJM, which serves 13 eastern states, has so far accepted all major load connection requests. It has seen many billions of dollars in increased capacity spending for the near-term, is facing shortage risks, and is coping with significant uncertainty in its longer-term planning as some datacenters may never be built at all.

BC, Alberta, Quebec, and Ontario have all taken early steps to manage this risk. Or rather, to buy themselves time to figure out how to manage this risk. British Columbia passed a ban on some activity and strict limitations on others. Fellow hydro producers, Ontario and Quebec built new reviews into connection processes. And, Alberta capped major load connections until 2028. Its cap was fully subscribed almost immediately.

Governments must find ways protect the grid without missing out on real economic wins. We should start to see proposals this year.

How much dirtier our power gets

Power sector emissions are set to climb in some regions over the next several years and won’t be reduced as quickly as they could be in others. The question is how dirty the grid will get.

Saskatchewan said it will spend $900 million refurbing three aging coal plants to operate them beyond the federally required shutdown date in 2030 – a date no other province is planning to exceed. Don’t shame the prairies though, Ontario is also anticipating emissions increases. Ontario has abundant clean resources but anticipates gas will play a larger role in meeting demand over the next 20 years while it refurbs and builds its many, many planned nukes.

Meanwhile in Atlantic Canada, New Brunswick is building new gas and hydro giant Newfoundland is building new diesel-fired turbines to replace older fossil fuel-fired plants.

All of these investments could have been directed to cleaner options within the current timelines and within budgetary constraints. This year could be pivotal in determining how emission-free technologies are factored into planning.

How we overcome our fear of wires

Canadians like to faun over Texas’ renewable sector but how did it get there? It kickstarted investment by creating competitive renewable energy zones and spending billions on transmission to advance wind power development. It worked so well that now Texas lawmakers can’t stop the renewables growth they started.

More recently, power supply development elsewhere in the US has been stymied by transmission deployment and interconnection delays. Has Canada been learning from these experiences? Nope, not really.

Canadian provinces seem oddly uncomfortable investing in new transmission, whether inter-provincial links or development-fostering lines like Texas once built. There are a few exceptions but for the most part, new transmission has been a last resort. I say it’s odd because new transmission and/or non-wire grid alternatives can reduce the new supply needed, which can save a lot of money when done properly.

Some provinces seem to be tentatively broaching the subject. BC has proposed a $6 billion+ transmission line to move power from its southeast to the northwest, based on forecasted but yet to materialize demand. Alberta is reevaluating how transmission is planned and costed to improve network efficiency. And, Nova Scotia has made progress on two interprovincial links.

It remains to be seen whether any of these plans or others on the horizon will be sufficient and/or appropriate to support growth but they could indicate that Canada is getting more adventurous with transmission potential. There may be lots to talk about this year.

How well we’re able to plan ahead

Ontario has a long-term planning problem. Every annual demand forecast it has put out in the past six years has been wrong. Each year we learn that it has, once again, dramatically underestimated the province’s long-term demand in its preceding outlook.

This is largely because of how Ontario’s electricity market administrator, IESO, creates its forecast. IESO bases its forecast on near-certain known demand and performs no meaningful scenario analysis. Scenarios typically include a slow development option where there isn’t much growth, a medium estimate and a high growth alternative. They enable identification of “no regrets” investments that will be beneficial under all scenarios and help to gauge the risk in larger investments. Most major electricity markets use this tool for planning. In Canada, most don’t, which makes planning and procurement unnecessarily opaque.

The good news for Canadian ratepayers is that 2025 saw very tentative moves in several provinces toward addressing this shortcoming.

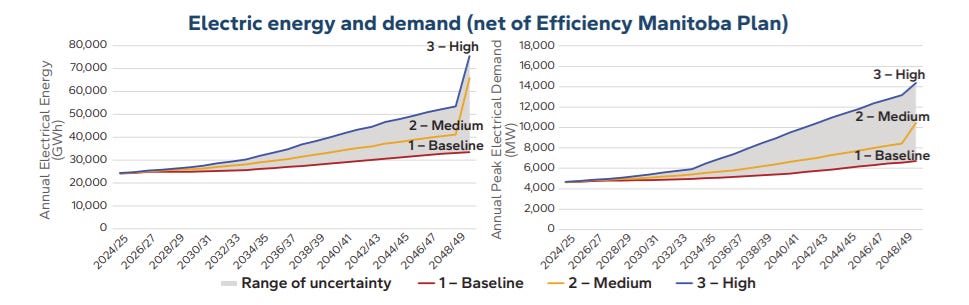

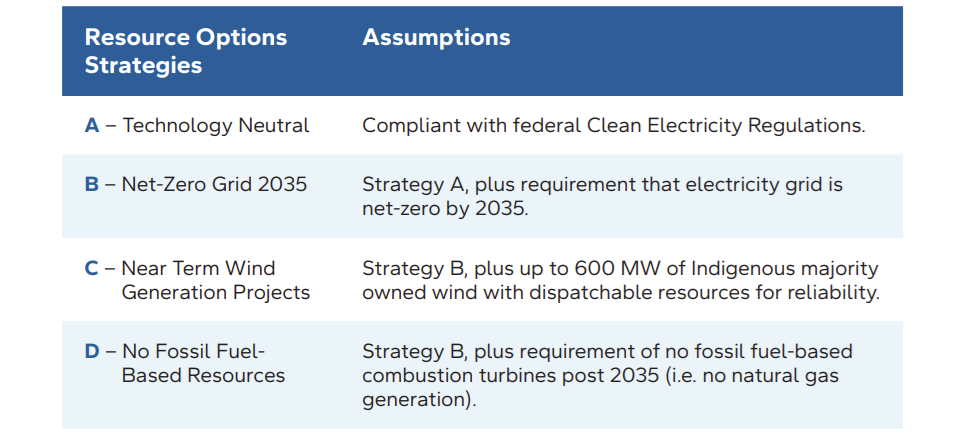

Ontario released a plan in 2024 that would see it move toward more fulsome planning and oversight though it hasn’t made any obvious steps in that direction yet. Nova Scotia has taken early steps toward establishing a market administrator tasked with preparing an Integrated Resource Plan (IRP) – a long-term plan that would be subject to review and approval. And, Manitoba is working on its second ever IRP to include long-term forecasts and alternative scenarios (see below).

This planning could be pivotal to maximizing Canada’s opportunities without overpaying. It could also help attract investment in Canada’s electricity markets via increased transparency and certainty.

How affordable we make it

Last but definitely not least in the stories to watch this year will be changes to market structure, contracts, and rates underway in multiple markets.

Almost every province has a major procurement planned this year under which they will purchase new gas, wind, solar, storage, hydro and/or nuclear power. The deal structures, the competitiveness of the processes, and the rates agreed to will impact the affordability of electricity in Canada for decades.

At the same time, Ontario, Alberta, Nova Scotia and PEI are all currently developing and/or considering major market changes. These updates impact everything from how electricity is sold, to which entities are allowed to buy and sell, to how pricing varies by location and ratepayer.

In some cases, like Ontario and Alberta, the market models are brand new. In other places, the models are well known but new to the province. What we know for sure is that utility rates have been climbing. Proposed market changes are intended to help curb or even reverse some of these increases. We will begin to understand this year the degree to which the right choices are being made.

2026 with Powering Canada

There is a lot more I haven’t touched on that will impact the shape of Canada’s electricity sector, the rates we pay, and our ability to thrive in this economic upheaval. I hope you’ll subscribe to have these updates sent to your inbox as we explore this exciting sector together this year.